China tariff stacking drives true prices for import taxes over 30%.

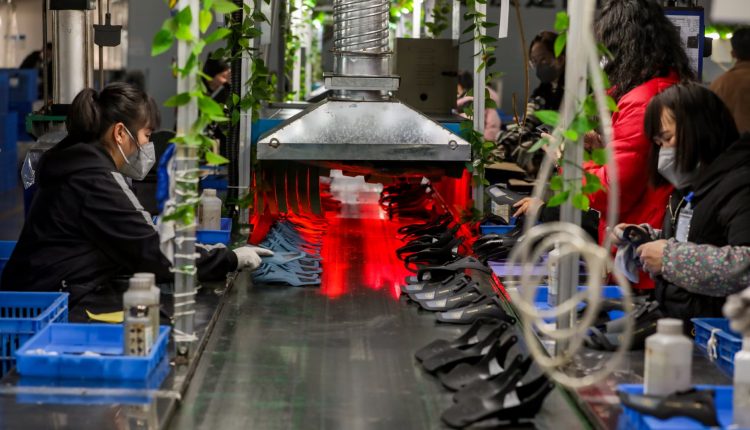

China News Service | China News Service | Getty pictures

The Trump government's commercial weapon arrest with China, which held the steepest tariffs for Chinese goods, does not offer many importers much relief. The stacking of several tariff layers that have already been implemented during the trade war has increased the costs for the import of retail goods that were imported well above the 30% in connection with the provisional agreement in connection with the provisional agreement.

“While companies are relieved to see a temporary break from the incredibly high tariffs for goods from China, retailers are still affected with very high tariffs that affect the prices and the offer,” said Josh Teitelbaum, Senior Counsel of Akin.

“Several tariffs are a big problem for basic objects such as children's backpacks that come from China mostly,” said Dan Anthony, President at Trade Partnership Worldwide. “You speak of over 70%,” he said.

This includes the overlay of existing 17.6% tariffs and section 301-in-tariffs (in connection with unfair trading practices) of 25%, whereby the tariffs of 30% for Chinese goods are not included in the break-20% fentanyl-related tariffs and 10% mutual tariffs.

Walmart CFO John David Rainey said in a CNBC interview after his income this week that prices for goods such as food, toys and electronics could rise due to tariffs. “We try to navigate the best we can,” he said in the CNBC interview. “But that's a bit unprecedented in terms of speed and size in which the price increases come,” he added.

The Panjiva data shows from January 2025 to May 12th. Walmart's three countries in which the programs come are China (34.1%), followed by India (26.3%) and Hong Kong (10.6%).

For many importers, the real tariff tax for Chinese goods is now between 40% and 70%.

Teitelbaum offered shoes as an example with a children's sneaker for children or women who today imported a tariff of 40% of China.

Stacking tariffs increases the actual costs for many other retail goods much more than 30%, including:

- Cotton sweaters from China are with a tariff of 46.5% (16.5% preferred, plus fentanyl and mutual tariffs).

- Bathing suits from women from China are the most preferred with a tariff of 54.9% (24.9%, plus fentanyl and mutual tariffs).

- Babies from China's clothes look at a tariff of 41.5% (11.5% of the preferred nation as well as the fentanyl and mutual tariffs).

Matt Priest, President and CEO of The Footwear Distributors & Retailers of America, said CNBC that a tariff of 40% is simply not sustainable to the most popular category of imported women's and children's leather shoes for American families and shoes.

“These are everyday shoes – not luxury items – and the tariffs used only drive the costs at the cash register,” said Priest. “With almost $ 650 million worth almost $ 650 million, which were imported from China last year, it is clear that this policy influences the consumers of the working class disproportionately. It is time for a serious, non-partisan conversation about tariff reform that puts American families first.”

This stacking of tariffs has caused some small companies to cut product lines to alleviate the financial burden. Anjali Bhargava, founder of the Spice Company Anjali's Cup, says that your company will hire products if you are sold out.

Before the 30% tariffs were hit, it paid 25% of tariffs. “These cans were already more expensive than I could afford, but even if I was able to absorb the 30% tariff, as a small business owner I can afford the additional stress of uncertainty about how the story could change in the months to produce and send the cans,” said Bhargava. “The past few months have been destabilized,” she added.

Bhargava said it was important to maximize the potential of the operating capital that it was available and minimize unnecessary risks because expensive debts have become. Bhargava's credit line rose to 23% plus 2% in order to draw the money.

“My credit card interest is all in the high 20s, so interest rates are a big problem, and it was a big bottleneck to order five to six months before I can sell them,” said Bhargava. “I used this to buy the ingredients and packaging that are essential for these products, and now I have to concentrate on building a stronger basis for the company with them.”

Rick Woldenberg, CEO of Learning Resources, a family-owned company that produces educational toys and the Trump administration sued the tariffs-a hearing that is planned for May 27th-is only exposed to the 30% tariffs, but he said that the jump from zero to 30% is steep. Even if the break enables its company to import some articles, it has a high price.

“A 30% office, if we paid zero in the past, is a massive change in costs and forced a great price increase to cover it,” said Woldenberg. “I think this tax is very inflationary. We like the idea of participating in inflation, not, so we hardly look forward to the news.”

He said a book with finished goods and work in China, which was part of the production orders in the 45-60 days after Trump's global announcement by Trump on April 2, is probably imported by Chinese factory partners. “We can and should now alleviate this inventory and try to sell it here. For various reasons, we will set up the production of particularly sensitive products, but resources will continue and our migration from China remains active,” said Woldenberg.

The small business owners say that the tariffs affect business and their trust in the process.

“We still don't know what our costs are or will be and assume that future decisions of this administration will be at the last minute without notice and cause us further pain and disorders. We have no trust,” said Woldenberg.

Rick Muskat, President of the family -run shoe dealer Deer Hirschhirsch, who imported his goods from China and sold in large retailers, such as Macy's, Kohls, Jcpenney and Amazon, also said by reducing Chinese tariffs that the stacking of all existing tariffs had increased exponentential.

“Even at the” reduced “level, this will cause serious cash flow problems,” said Nuskat. “We paid 60,000 US dollars per month. Now we pay 360,000 US dollars a month. We have to reduce the costs to cover this and to achieve savings in the salary statement. We will also require that we increase the prices for future deliveries,” he said.

“The damage of the past few weeks cannot be reversed and can only be addressed with long -term assurance and stability that enable us to make the best decisions about how we can spend our money today, next week and next month, and prepare for success for success,” said Bhargava. “I will survive and I am quite optimistic that it will also be the business, but the stress, to find out, was rough and pulled me to the tribute. I had to get really slower and not in panic, but I find my way step by step.”

Comments are closed.